Apple (AAPL) is a company that always prides itself on its unique self-developed design. Now compare this to the recent deal to acquire Beats for $3.2 billion, allowing Dr. Dre to proclaim that he is the first billionaire in hip hop (he better hope he didn't jinx himself considering the deal hasn't actually been finalized yet) and some are left questioning; is this the right move?

So why don't we take a look at Apple's past acquisitions since 2001:

| Year | Company | Business | Value (USD) | Derived Products |

| 2001 | Bluefish Labs | Productivity software | — | iWork |

| 2001 | bluebuzz | Internet service provider | — | — |

| 2001 | Spruce Technologies | Graphics software | US$14,900,000 | DVD Studio Pro |

| 2001 | PowerSchool | Online info systems services | US$66,100,000 | PowerSchool |

| 2002 | Nothing Real | Special effects software | US$15,000,000 | Shake |

| 2002 | Zayante | FireWire chips and software | US$13,000,000 | FireWire |

| 2002 | Silicon Grail Corp-Chalice | Digital effects software | US$20,000,000 | Final Cut Pro |

| 2002 | Propel Software | Software | - | — |

| 2002 | Prismo Graphics | Special-effects titling software for film and video | US$20,000,000 | LiveType (Final Cut Studio) |

| 2002 | Emagic | Music production software | US$30,000,000 | Logic Pro, GarageBand |

| 2005 | Schemasoft | Software | — | iWork |

| 2005 | FingerWorks | Gesture recognition company | — | iOS |

| 2006 | Silicon Color | Software | — | Color (Final Cut Studio) |

| 2006 | Proximity | Software | — | Final Cut Server |

| 2008 | P.A. Semi | Semiconductors | US$278,000,000 | Apple SOC |

| 2009 | Placebase | Maps | — | Maps |

| 2009 | Lala.com | Music streaming | US$17,000,000 | iCloud, iTunes Match |

| 2010 | Quattro Wireless | Mobile advertising | US$275,000,000 | iAd |

| 2010 | Intrinsity | Semiconductors | US$121,000,000 | Apple SOC |

| 2010 | Siri | Voice Control Software | — | Siri |

| 2010 | Poly9 | Web-based mapping | — | Maps |

| 2010 | Polar Rose | Face-Recognition | US$29,000,000 | iOS |

| 2010 | IMSense | High Dynamic Range Photography | — | iOS |

| 2011 | C3 Technologies | 3D Mapping | US$267,000,000 | Maps |

| 2011 | Anobit | Flash Memory | US$390,000,000 | iPod, iPhone, iPad |

| 2012 | Chomp | App search engine | US$50,000,000 | App Store |

| 2012 | Redmatica | Audio | — | Logic Pro |

| 2012 | AuthenTec | PC and Mobile security products | US$356,000,000 | Touch ID |

| 2012 | Particle | HTML5 web app firm | — | iCloud, iAd |

| 2013 | Novauris Technologies | Speech recognition | — | Siri |

| 2013 | WiFiSlam | Indoor location | US$20,000,000 | Maps |

| 2013 | Locationary | Maps | — | Maps |

| 2013 | HopStop.com | Maps | — | Maps |

| 2013 | Passif Semiconductor | Semiconductors | — | — |

| 2013 | Matcha | Media discovery app | — | — |

| 2013 | Embark | Maps | — | Maps |

| 2013 | AlgoTrim | Data Compression | — | — |

| 2013 | Cue | Personal assistant | US$50,000,000 | — |

| 2013 | PrimeSense | Semiconductors | US$345,000,000 | — |

| 2013 | Topsy | Analytics | US$200,000,000 | — |

| 2013 | BroadMap | Maps | — | Maps |

| 2013 | Catch.com | Software | — | — |

| 2014 | SnappyLabs | Photography Software | — | Camera |

| 2014 | Burstly | Software | — | App Testing and Distribution |

| 2014 | LuxVue Technology | microLED Displays | — | — |

From the data available to us on this chart, since 2001 the highest amount Apple has ever spent on an acquisition was $390 million. However, this isn't even the most concerning factor. Pay close attention to the 'Derived Products' column. All of the acquisitions are made on products that are supplements to Apple's hardware. For example, Apple now uses the semiconductors purchased from PA Semi back in 2008 in its iPods and iPhones.

In this sense, Apple has never bought a pre-established brand for a physical product. It has purchased brands for software but these are simply to acquire their functions as they can be easily redesigned to give it the 'Apple look'. This is because Apple does better when they design the products themselves. How do they plan on incorporating Beats as an Apple brand?

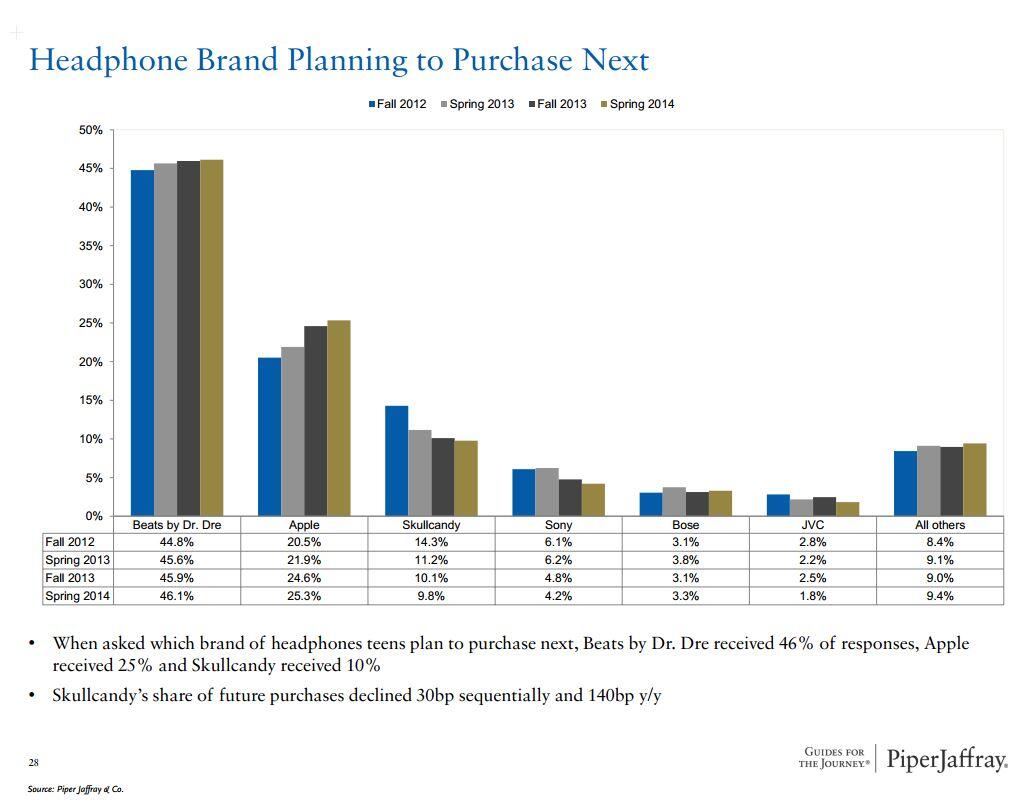

Now some might argue that Tim Cook's logic is derived from this slide:

So, Tim Cook is thinking that if he buys Beats he can solidify Apple's position as the primary choice for headphone purchases. One problem is that there is a decreasing trend in growth for Beats' planned purchases: Spring 2013 @ 1.8% growth, Fall 2013 @ 0.7% growth, and Spring 2014 projected @ 0.4% growth.

Now let's consider why this planned purchased growth might be slowing. The Beats brand is directly targeted at those born in the late 80s to late 90s (those that are 14 to 25 years old). The issue with this is that this generation is rapidly moving away from the hip hop and "Dr. Dre" scene. This combined with the fact that the general opinion of 'audiophiles' being that Beats offers sub-par quality for too high of a price is exactly why I don't think Beats is a great purchase for Apple.

Of course, it's hard to argue with the fact that by purchasing Beats, Apple is expected to own over 70% of planned purchases for Spring 2014 but if I was dropping $3.2 billion I would want a guarantee that it's going to payoff for years into the future.

So there must be more to it than this simple graph indicates. It's been rumored that Apple is also making the purchase to take advantage of Beats' new music streaming service. My answer to this is that it's completely unnecessary to drop $3.2 billion. If Apple took $500 million of this money, along with its army of developers, I'm sure it could develop a music streaming service that blows whatever Beats has out of the water.

To me, purchasing Beats looks more like a way out of the recent accusations of Apple holding too much cash as opposed to a smart business decision. Shareholders are wanting Apple to spend some of their $130 billion held in offshore accounts. If this is truly Apple's solution to that issue, they have a steep road ahead.

Disclaimer: I do not own shares of Apple or a pair of Beats headphones ;)

No comments:

Post a Comment